Is Hedera Hashgraph (HBAR) a Good Investment?

Hedera Hashgraph (HBAR) is considered a terrific long-term investment opportunity and probably one of the few cryptocurrencies that could generate profit in the face of a bear market or adverse economic conditions.

Hedera is a good investment because its technology is superior to all other cryptocurrency. Hedera Hashgraph presents itself as a faster and more secure alternative to blockchain, and its low bandwidth consumption makes it more environmentally friendly. It has been rumored that Hedera is working on the digital dollar with the Central Bank.

It has been argued that Bitcoin, NFTs and other crypto fads are destroying our planet, and the crypto boom in general, do more harm than good when it comes to the climate. Scholars argue that Bitcoin emissions alone could help raise the Earth’s temperature by two degrees.

To make matters worse, president Joe Biden has promised his administration will focus on environmental justice. Thus, future legislative action will require companies operating on blockchain to pay high climate taxes on transactions.

A good investment must also achieve regulatory compliance and that’s where Hedera shines. Hedera expected for governments to extend police objectives to users, enterprisers and developers utilizing public ledgers and associated cryptocurrencies and tokens. Hedera built their HBAR tokens enterprise to comply with applicable laws and regulations, such as European Union’s Privacy Regulations, and enable appropriate identity management to conduct sanctions screening and facilitate Know Your Customer (KYC) and Anti Money Laundering (AML) checks. When regulations arrive Hedera will be one of few enterprises that survive the government’s wrath. Hedera was carefully built to be the world’s first mass-adopted public distributed ledger who’s main objective is performance, security, governance, stability and regulatory compliance.

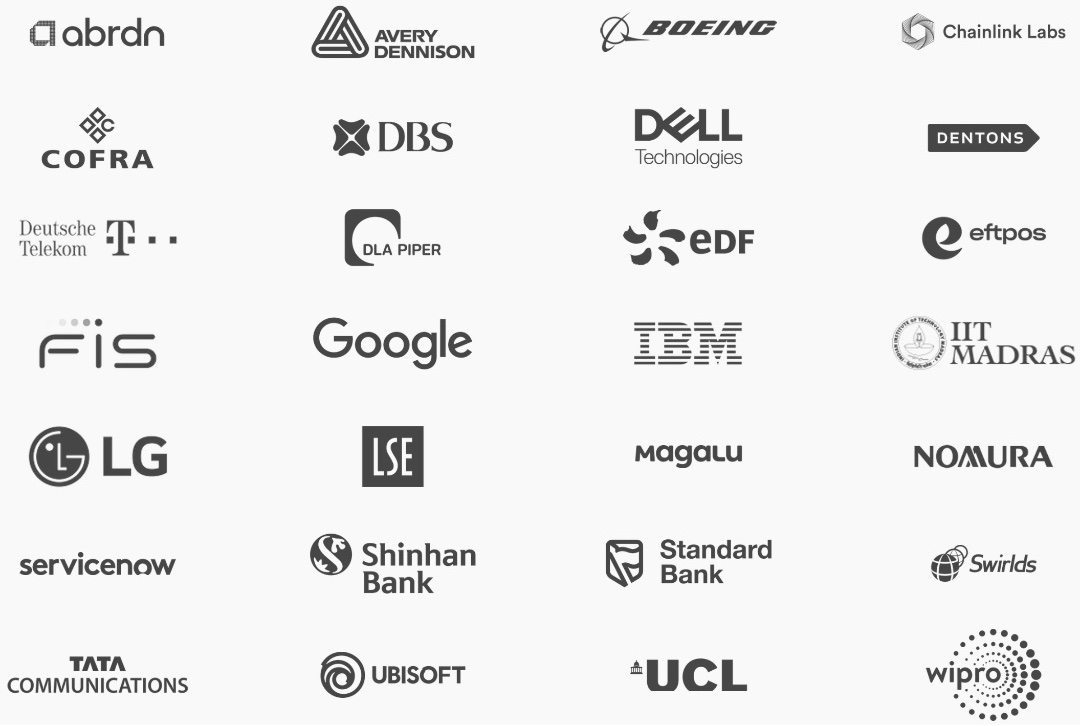

Hedera Hashgraph is the solution to cryptocurrencies biggest problems. It can realistically bring cryptocurrency mainstream and simultaneously save the planet. Hence, the reason why fortune 500 companies like Google, Boeing and IBM and other blue-chip enterprises reside on its governing council.

Hedera Hashgraph seems to have a far reaching vision, a well thought-out blueprint, and a shared commitment to long-term implementation. Remember, the greatest investors of all time have said “long-term is what yields maximum total return”.

Why HBAR is a Superior Investment Choice Compared to Other Cryptocurrencies

In the fast-paced world of cryptocurrencies, discerning investors seek assets with the qualities required for not only outstanding potential but also authentic value. Hedera Hashgraph (HBAR) emerges as a shining star in this arena, presenting a compelling case for investing money for profit with reduced gamble and risk.

HBAR: Powered by Real-World Adoption

Hedera Hashgraph’s strength lies in its real-world utility and enterprise adoption. Unlike many other cryptocurrencies that survive purely on hype, HBAR is making its mark by actively integrating into global business operations. The wide-reaching enterprise adoption of HBAR sets it apart from the crowd, fueling its value through concrete use cases. As businesses across industries embrace HBAR for enhanced security, scalability, and efficiency, the cryptocurrency benefits from a consistent, organic demand. This high demand, driven by genuine utility, creates a foundation of value that significantly mitigates investment risk.

Supply and Demand Dynamics: A Winning Combination

One of HBAR’s distinct advantages is the way it harnesses supply and demand dynamics. Worldwide enterprise adoption of HBAR creates a robust and sustainable demand, resulting in upward pressure on its price. As more businesses recognize the advantages of using HBAR for their operations, the supply of HBAR is naturally absorbed, further contributing to its value appreciation. This is a stark contrast to cryptocurrencies like ADA, which heavily rely on hype alone. The sheer scale of enterprise adoption for HBAR not only boosts its value but also minimizes the speculative nature of its price movements, offering investors a calculated and logical avenue for profit.

HBAR: Beyond Hype, Towards Sustainable Growth

Market hype can often be misleading, and while cryptocurrencies like ADA may experience short-lived spikes in price based on speculative fervor, these gains are often ephemeral. ADA’s reliance on hype alone leaves it vulnerable to fluctuations driven by sentiment shifts, putting investors at a higher risk of losing out. In contrast, HBAR’s foundation of real-world adoption provides a sturdy shield against market volatility. When a digital asset consistently lives up to its promises, like HBAR does with enterprise adoption, investors are more likely to place their trust and funds where they can realize genuine and sustainable profits.

In conclusion, Hedera Hashgraph (HBAR) emerges as a superior investment choice, backed by its authentic enterprise adoption and robust supply-demand dynamics. Unlike cryptocurrencies that rely solely on hype, HBAR’s value is grounded in its real-world utility and adoption, making it a promising asset for investors seeking profit with minimized risk. As the cryptocurrency landscape evolves, HBAR’s trajectory of growth driven by enterprise adoption and genuine demand sets it apart as an exceptional opportunity for those who prioritize potential and authenticity in their investment decisions.

What is a good investment, anyway?

A good investment hinges on your capacity to bear a risk while marching towards a targeted financial goal. At its extent, the goal of any investment is to generate profit while navigating through the maze of financial and reputational risk. This makes the concept of ‘good investment’ rather contingent; on any individual’s forbearance with the level of risk and permissible fortuity. Hence it becomes important to take cognizance of all factors before investing your money in any project or proposal.

Regardless of form and factor, a good investment returns profit all the while steering through risk domains. Any good investment must conceptualize from a sound financial plan. This necessitates a carefully calculated financial goal, a meticulously computed investing budget and sensible forecasting in lieu of assets’ value. Apart from an asset’s growth potential, it is pertinent to adduce its leverage within your overall investment portfolio. If, for example, you are extracting a respectable profit from cryptocurrency, it may be prudent to balance the risk of investing in cryptocurrency by investing in real estate or government-issued bonds. Since regulatory proscription represent the inherent risk of investing in cryptocurrency, it bodes well to diversify your investment portfolio with choosing other sectors and industries.

A diversified investment portfolio is more likely to stand the test of regulatory impositions, financial meltdowns and market dynamics. In fact, portfolio diversity has become a touchstone for success within the investors’ circle. Not only it abates the blow of risk but also provides a breather when times are tough.

Ultimately, the goal of any investment is to secure a kosher financial standing. This is only possible if you have considered all the factors that influence an investment. Among many instruments of evaluation, a company’s business and financial plan is the foremost document to study intently. These can reveal a lot about a company or product’s market reputation and its ability to weather the storm of financial uncertainty. Other factors include the macro-economic environment of your intended investment sector, the demand and supply exploits and the eventual cost of ownership.

Once you have accounted for these mitigating circumstances and eventualities, you job is only half done. Don’t forget that committing to an investment is a human activity and like all human activities, it is prone to frailty and foible. Keep a keen eye on the psychological peculiarities of the market and don’t fall for offers that promise too much on too little. Any investment that you desire to make and profit from is limited by unseen factors. It is imperative to infer those limitations before embarking on an investment frenzy.

All told, a good investment is marked by longevity of returns rather than its apparent profitability. The hallmark of a good investor is to appreciate the total sphere of an investment before committing his/her money to it. A minor oversight can bring untold privations, and on the other hand, a pinch of prudence can turn wonders for you in the investment market.

This content is for entertainment purposes only, you should not construe any such information or other material as investment, financial, or other advice.

The article says HBAR is “considered a terrific long-term investment”. What is considered long-term, 1 year, 2 years, 5 years, and why is it viewed as a long-term project? What will happen in the future that will improve its worth?

Because the best investment on earth is earth—it’s environmentally friendly whereas bitcoin is a disaster. Plus, the biggest corporations are backing HBAR so go where the money is—HBAR.

Completely agree. Hbar and Xrp both have great utility and low energy consumption Xrp is 0.0079 so still nearly 8 times more than Hbar. Xrp is embroiled in a legal case at the moment which could cause it major problems, but it also has ties to major corporations. So Hbar wins at the moment, but I hold both for the long term.

I also agree. Utility is the king. And those two coins are unbeatable at the moment. I think HBAR is a real paradigm shifting. Two dimensions in data storage – instead of one. I simply hodling – both :))

please tell me about other good coin .which i can invest to i have xrp and hbar

I like what was said about HBAR , I own some XRP and Cordona am new to the game but trying to learn. Enjoy your report.

Get ready for a world powered by Hedera Hashgraph (HBAR) – the ultimate game-changer! With lightning-fast transactions and top-tier security, HBAR is set to revolutionize industries across the globe.

Investing in HBAR now could lead to astronomical returns, as global adoption drives its price to new heights. Don’t miss out on the chance to ride the HBAR wave to financial success – it’s your ticket to the moon and beyond! #HBARToTheMoon

Just swapped all of my Bitcoin for HBAR! Excited about Hedera’s potential to transform transactions and data handling. Cheers to a new investment path! #CryptoSwap #HBAR

You should have invested in Solana!

Solana? Hedera hbar offers a compelling edge over Solana in terms of security, fairness, and energy efficiency. Unlike Solana’s Proof of History, hbar employs the patented Hashgraph consensus algorithm, which mathematically guarantees fairness and prevents certain types of attacks. Additionally, hbar’s asynchronous Byzantine Fault Tolerance consensus is more resilient to malicious actors, enhancing overall security. Furthermore, hbar’s innovative gossip protocol ensures high throughput without the need for energy-intensive Proof of Work mechanisms, making it an environmentally conscious choice. With these advantages, hbar stands as a superior option for enterprises seeking a secure, efficient, and eco-friendly blockchain solution. Basically, SOL is garbage pump dump.